Are you ready for AASB S2 Mandatory Climate-Related Financial Disclosure?

From January 2025, large businesses in Australia will have to share detailed reports on how the climate impacts their operations. This requirement comes from a proposed law by the Department of Treasury.

To help these businesses report accurately, the Australian Accounting Standards Board (AASB) has published a set of guidelines called the Australian Sustainability Reporting Standards (ASRS).

Ready to get started?

Australian Sustainability Reporting Standards (S1 & S2)

To date, two ASRS standards have been issued:

AASB S1 (voluntary standard): General Requirements for Disclosure of Sustainability-related Financial Information

AASB S2 (mandatory standard): Climate-related Disclosures

These standards are largely aligned with the International Sustainability Standards Board (ISSB) standards IFRS S1 and S2.

What Needs to Be Reported?

01

GOVERNANCE

-

This includes:

The individuals (such as board members) or committees charged with overseeing CROs.

How climate-related responsibilities are incorporated into the broader governance framework.

The means by and frequency with which the individuals or committees are informed about CROs.

How the setting of climate-related targets are overseen and monitored.

02

STRATEGY

-

This includes:

Business Impacts: Impacts of climate change on the entity’s business model, value chain, financial position and cash flow.

Time Horizons: Short, medium and long-term time horizons must be considered, with an explanation of how they align with strategic decision-making timeframes.

Scenario Analysis: The Corporations Act 2001 mandates the use of at least two scenarios: one where global temperature increase is limited to 1.5°C and one where it well exceeds 2.5°C.

03

RISK MANAGEMENT

-

This includes:

Processes and policies for assessing climate risks, including key inputs, use of scenario analysis, risk evaluation methods, and any changes made during the period.

How climate-related risks are identified and whether they are integrated into the overall risk management framework or treated separately.

04

-

This includes:

GHG emissions - Scope 1, 2 and 3

Assets at risk from both physical and transition climate impacts

Assets or business activities aligned with climate-related opportunities

Capital, financing, or investments directed toward addressing CROs.

Internal carbon prices

Proportion of executive remuneration linked to climate-related factors.

Details of climate-related targets set by the entity and the metrics used to track progress.

METRICS & TARGETS

Who Needs to Report?

Are You a Group 2 or Group 3 Company?

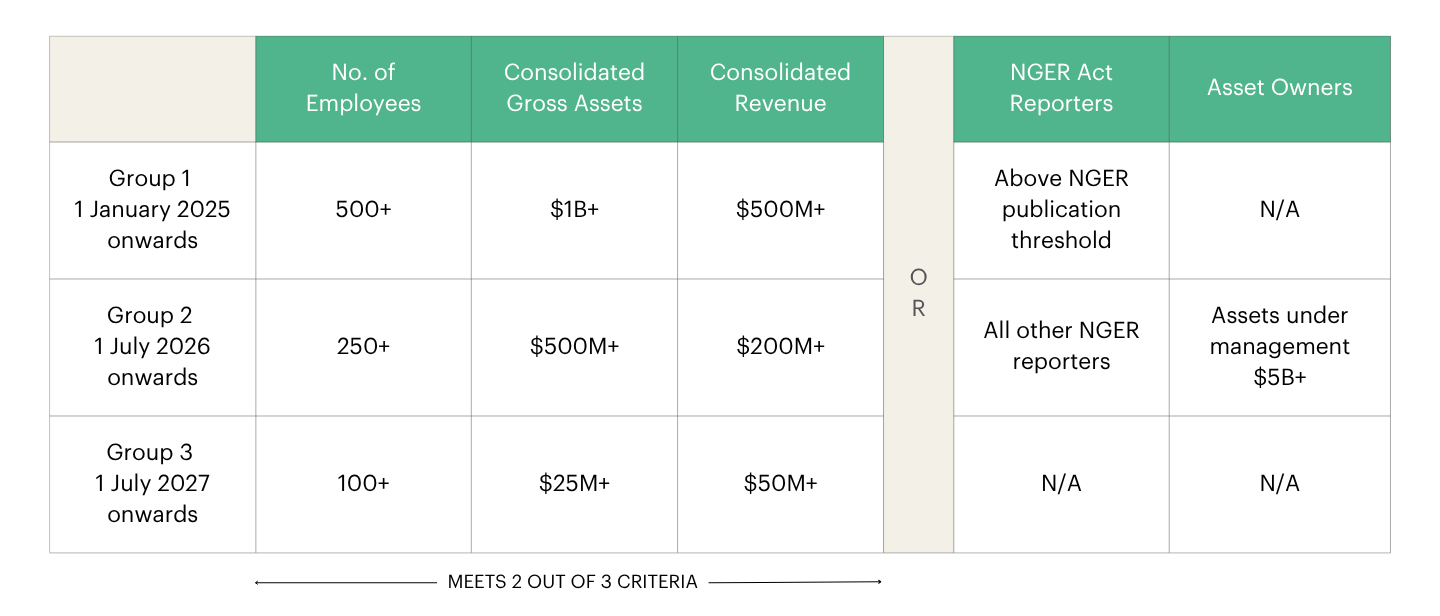

From 1 July 2026 and 1 July 2027, Group 2 and Group 3 companies respectively in Australia will be required to publish mandated climate‑related financial disclosures under AASB S2.

Group 2: Entities whose first annual reporting period applying AASB S2 begins on or after 1 July 2026.

Group 3: Entities whose first annual reporting period applying AASB S2 begins on or after 1 July 2027.

These groups include companies in mining and resource‑intensive industries that meet the qualifying thresholds (e.g. size, employees, assets, greenhouse‑gas emissions reporting obligations).

Early preparation is key. Speak to our AASB S2 experts today.

A Readiness Assessment is a good starting point and may include:

Clarifying disclosure requirements relevant to your organisation

Running a materiality discovery workshop to identify existing information and key contacts

Delivering tailored training to educate and engage internal stakeholders

Conducting a gap analysis of existing material against AASB S2 requirements

Presenting findings and outlining recommended next steps for disclosure readiness

Ready to get started?

Greenbase is a GRI certified software and tools partner.

We license and apply the IFRS® Sustainability Disclosure Standards, SASB® Standards, and SICS in our work.